Warning: Attempt to read property "post_excerpt" on null in /home/kogiflam/public_html/wp-content/themes/morenews/single.php on line 55

Kogiflame

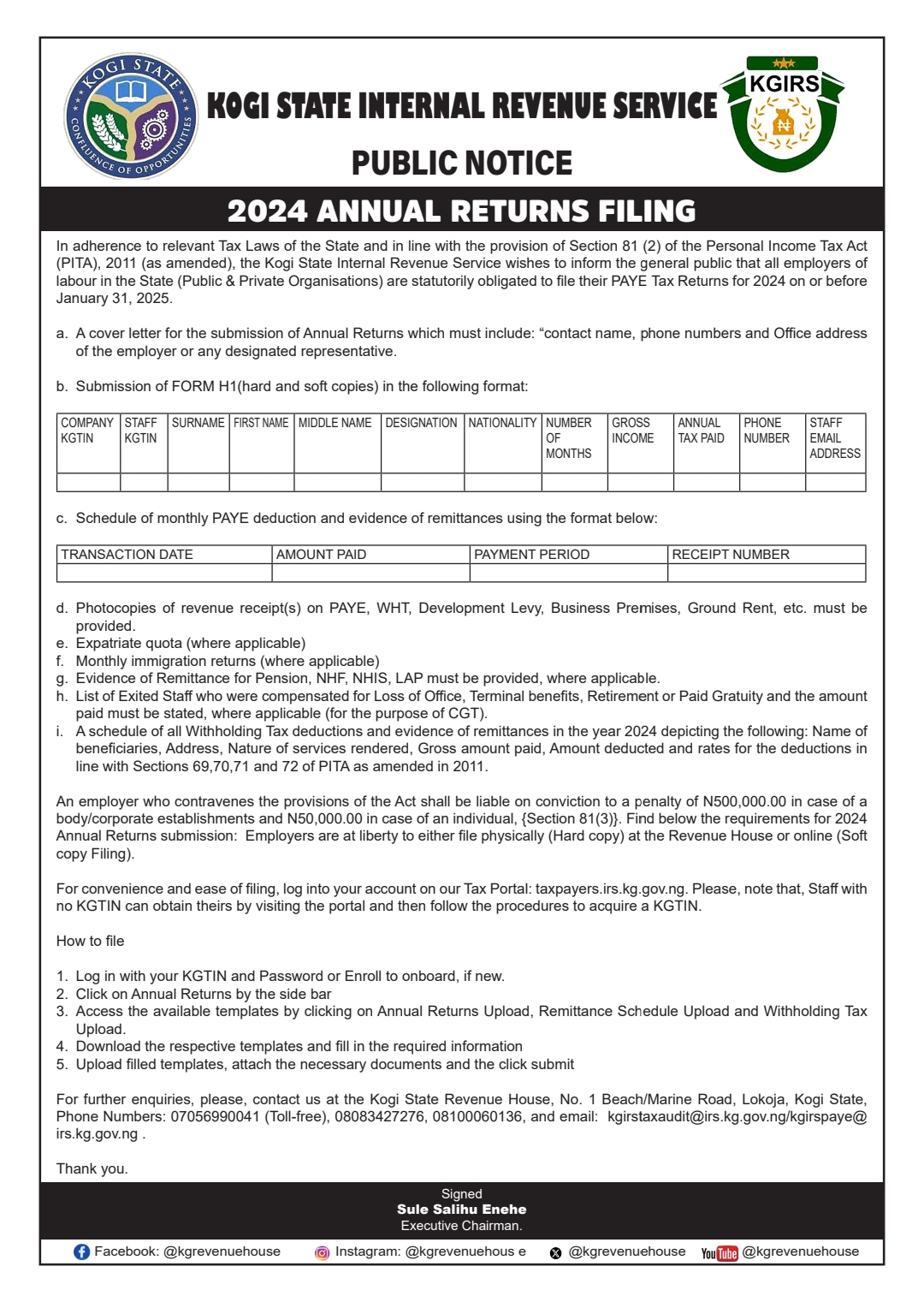

Kogi State Internal Revenue Service (KGIRS), has sealed the network facilities of two telecommunication companies operating in Kogi State for their refusal to remit tax liabilities worth over N360 million to the State Government.

The Director of Legal Services and Enforcement, Barrister Saidu Isah Okino, ably represented by the Head of Enforcement Department of the Revenue Service, Alhaji Abubakar Obori, who led the team to seal the facilities of the two companies at the Mount Patti Hill, and across the State, lamented that besides the fact that the two companies; GLOBACOM NIGERIA LTD AND AIRTEL NETWORKS LTD, have all refused to meet their tax obligations to the tune of N360,035,000.00, they have constantly evaded the fulfillment of such civic duty.

Giving the breakdown of the taxes owed by the two telecommunication companies, Okino revealed that Globacom Nigeria Ltd, Kogi State, unremitted tax liabilities run into Three Hundred Million Naira (300,000,000), both Corporate and Individual, and on Social Service Contribution Levy (SSCL) covering from year 2017 through year 2021.

Also, Airtel Networks Ltd, Kogi State, defaults on the Social Service Contribution Levy, and on Corporate and individual tax liabilities to the tune of Sixty Million and Thirty Five Thousand Naira (N60,035,000.00).

According to him, “The Service has written several letters to the Management of the companies to pacify them to pay the taxes they owe the Kogi State Government but had never shown any sign of commitment.

“The sealing of the sites and properties was at the instance of a High Court Order sitting in Lokoja, Kogi State, and until they pay their tax liabilities, the Service will not unseal the sites located at the Mount Patti, and across Kogi State.”

Okino further called on other defaulters to pay their outstanding tax liabilities to avoid sealing of their business facilities by the Service as tax enforcement procedures is a continuous one.