Warning: Attempt to read property "post_excerpt" on null in /home/kogiflam/public_html/wp-content/themes/morenews/single.php on line 55

Kogiflame

Kogi State Internal Revenue Service (KGIRS) has denied any illegal taxation on telecom giants operating in the state.

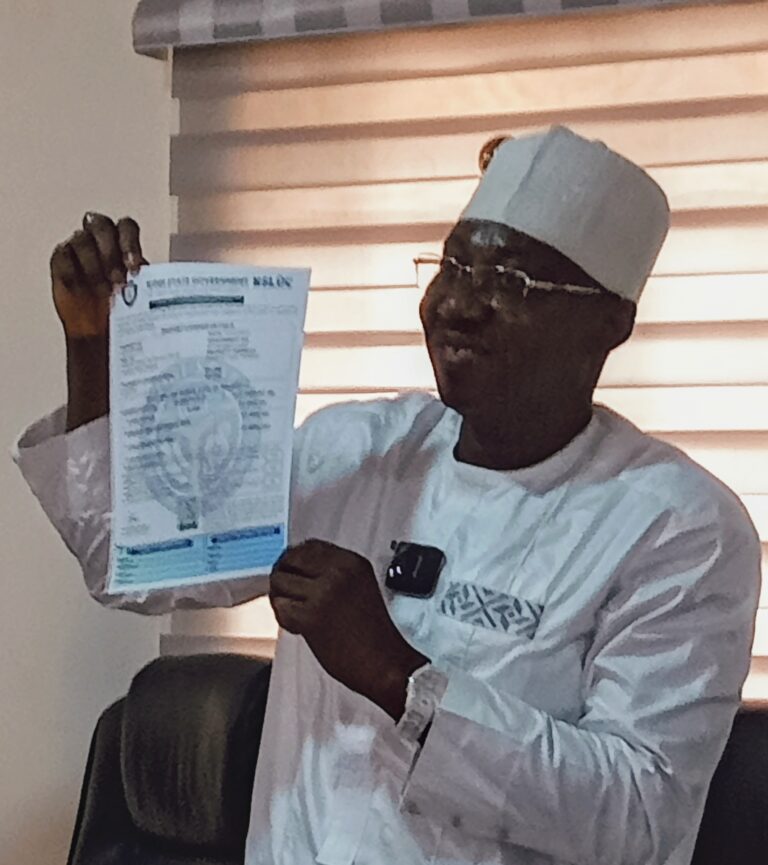

Addressing newsmen at the Revenue House, the Acting Executive Chairman, KGIRS, Alhaji Sule Salihu Enehe while reacting to the alligation made against the organisation, noted that as an organisation, KGIRS has tremendous respect for the rule of law and will not take any action that infringe on the rights of individuals and corporate organisations.

“We also maintain a cordial relationship with organisations to compliment the efforts of government at making Kogi State the investment haven of Nigeria

“KGIRS was in a tax default battle with three major telecom giants including MTN Nigeria Communication, a situation which MTN Nigeria Communication responded to responsibility by immediately clearing their tax liabilities of N60 million naira but GLO and AIRTEL refused to clear their abilities

“It should be noted that KGIRS deals with Telecom companies individually and not with an Association of Telecom Providers.

“Also, the court issues highlighted in the petition was the case of business premises, whether the telecommunication mast can be regarded as Business Premises by virtue of Section 2 of Kogi State Business Premises Law 2017. The matter was decided by the Federal High Court Lokoja in favour of the Telecom Association against the registrar of business premises, Kogi State, and four others of which the state filled a notice of appeal thereto and now before the Court of Appeal, Abuja.

According to him, several demands notices have been sent to the two defaulting Telecom companies but they refused to oblige stressing that the said liabilities include Globacom Nigeria defaulting at N300 million naira unremitted tax labilities.

“Both corporate and individual, and Social Service Contribution Levy from 2017 through 2021, Also Airtel Network Limited defaults at over N60 million naira both corporate and individual tax liabilities

“All these payments are to be paid by virtue of law of the Kogi State House of Assembly duly passed which allows KGIRS to collect the levies and fees on these premises. While MTN Nigeria Communications has come to settle their tax liabilities, we expect the remaining two GLO, AIRTEL to do same,” he said.

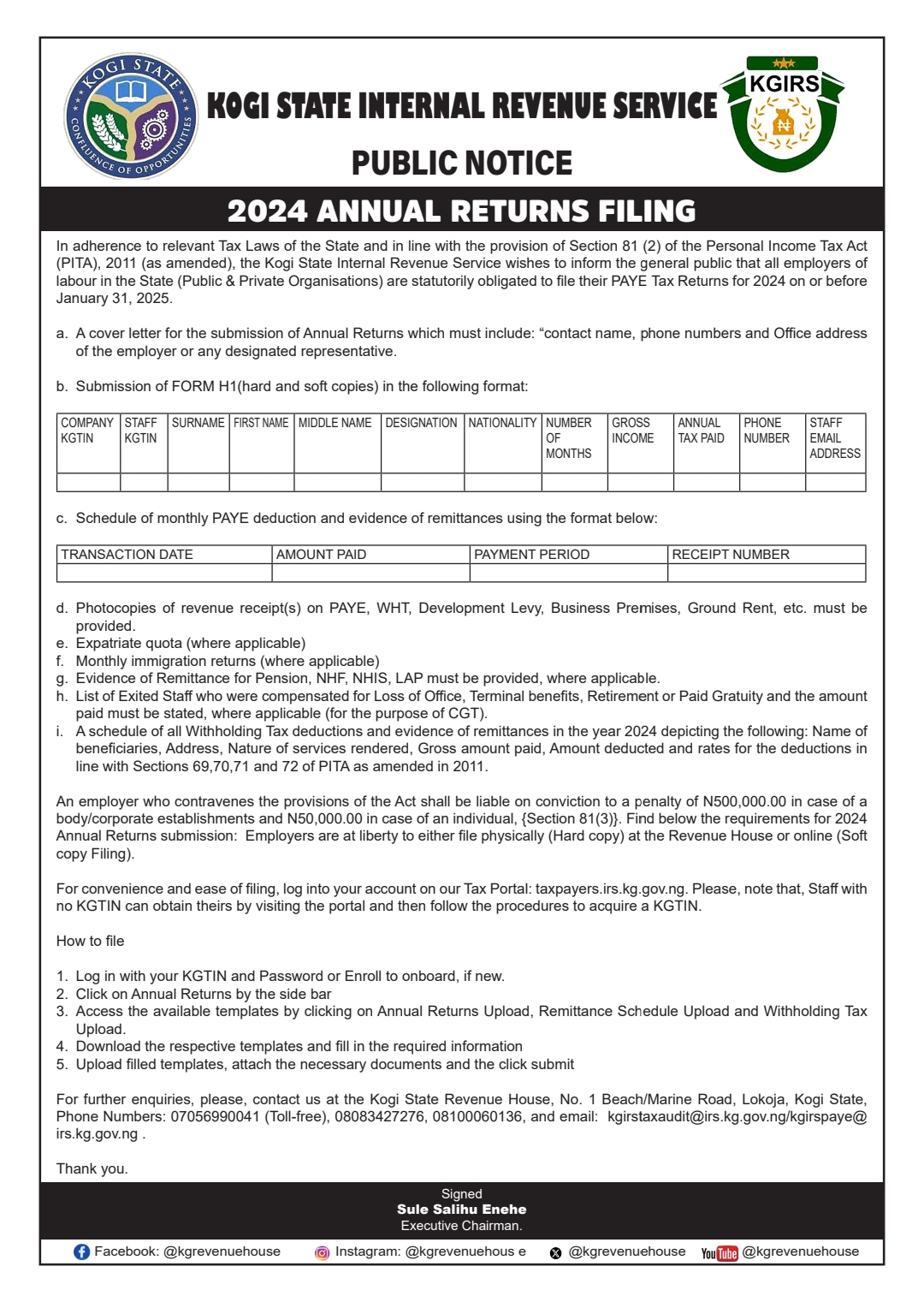

The Acting Chairman noted that the one their organisation is dealing with right now is on Social Service contribution Levy, both individual and corporate bodies and this is under the extant law of Kogi State Harmonisation Law, 2017.

He therefore called on corporate organisations to reciprocate their open door policy and the conducive environment provided by the administration of Governor Yahaya Bello by paying their taxes duly.