Kogiflame

Emmanuel kehinde,Ilorin

The Federal High Court of Nigeria, in the Uyo Judicial Division, presided over by Hon Mr Justice J.E. Inyang, has ordered the Federal Inland Revenue Service to release to Akwa Ibom State Internal Revenue Service the total sum of N7,155,109,346.00 (Seven Billion, One Hundred And Fifty-Five Million, One Hundred And Nine Thousand, Three Hundred And Forty-Six Naira) being the PAYE tax liability due to the plaintiffs from the defendants.

According to a copy of the judgement made available to journalists on Wednesday, Justice Inyang, during the court session held in Uyo, the Akwa Ibom State Capital, gave the judgement on Friday, 9th day of December 2002.

Justice Inyang said, “The plaintiffs have proven their case and the question is answered in the affirmative. The declaratory reliefs and the Orders they seek are hereby granted.

“It is further ordered that the defendants, forthwith release the total sum of Seven Billion, One Hundred and Fifty-Five Million, One Hundred and Nine Thousand, Three Hundred and Forty-Six Naira to the plaintiffs.

“Costs assessed and awarded in the sum of N1,000,000.00 (One Million Naira) in favour of the plaintiffs, to be paid jointly and severally by the defendants within seven days of this judgement.”

The plaintiffs in suit No:FHC/UY/CS/199/2022 were the Attorney General of Akwa Ibom State and Akwa Ibom State Internal Revenue Service.

The defendants were: Federal Inland Revenue Service (FIRS), Attorney General & Minister of Justice of the Federal Republic of Nigeria; Accountant General of the Federation and Minister of Finance of the Federal Republic of Nigeria.

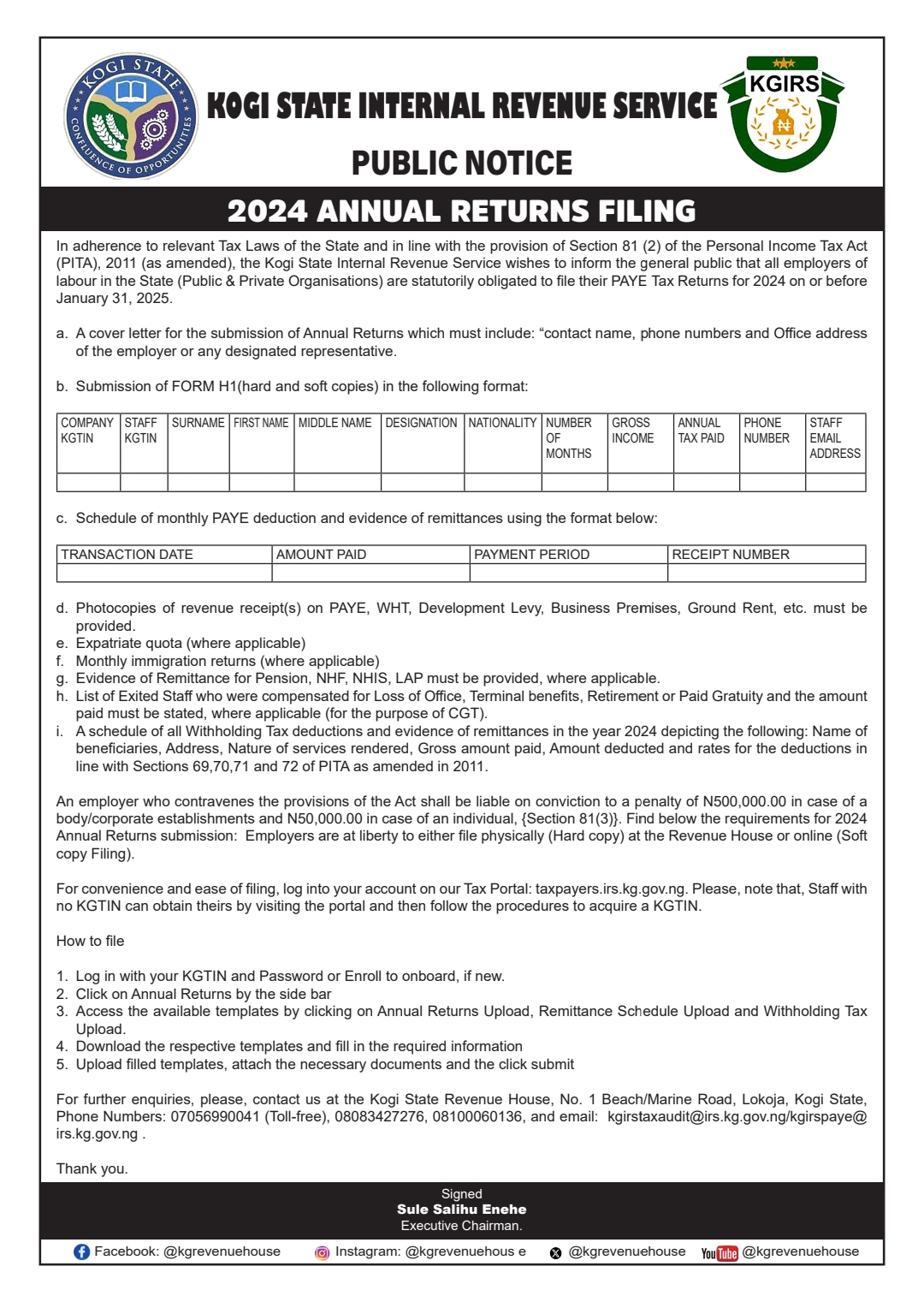

In an originating summons filed on 24th August 2022, the plaintiffs raised the following question for determination. ‘Whether by the provisions of Section 8(1)(g) and 34(1) of the Federal Inland Revenue Service (Establishment) Act, the defendants can offset the disputed tax liabilities pending in Court using the Pay As You earn (PAYE) tax due to the plaintiff from the defendants.

The plaintiff sought the following reliefs if the question is answered in the affirmative:

1. A declaration that the concluded plan by the defendants to offset the disputed tax liabilities pending in court using the Pay As You Earn (PAYE) tax due to the plaintiffs from the defendants is illegal and unlawful.

2. An order of this Court restraining the Defendants by themselves, privies, servants or agents from offsetting the disputed tax liabilities pending in Court using the Pay As You Earn tax due to the Plaintiffs from the defendants.

3. A perpetual injunction restraining the defendants, their agents, privies, servants and assigns from offsetting the disputed tax liabilities pending in Court using Pay As You Earn Tax due to the plaintiffs from the defendants.

4. An order of the court directing the defendants to release the total sum of N7,155,109,346.00 (Seven Billion, One Hundred and Fifty-Five Million, One Hundred and Nine Thousand, Three Hundred and Forty-Six Naira) being the PAYE tax liability due to the plaintiffs from the defendants.

5. Any other Order or Orders as this Honourable Court may deem fit to make in the circumstances of this case.

The plaintiffs supported the Originating Summons with an Affidavit of twenty paragraphs deposed to by Mr Samuel Isanh, Litigation Officer in the Office of the Attorney-General of Akwa Ibom State.

Giving insight into the judgement, Justice Inyang wrote inter alia:

“The brief and salient facts of this case as borne out from my evaluation of the totality of the affidavit evidence adduced in this matter: are that the defendants seek to deduct the PAYE tax due to the plaintiff to offset disputed unremitted tax liability of the plaintiff. Indeed there are several matters pending before the Tax-Appeal Tribunal and this Court in that regard.

“The defendants assert that by virtue of Section 24 of the FIRS Act, the 3rd defendant has the power to deduct at source from the budgetary allocation, unremitted taxes due from any ministry or government agency and thereafter transfer such deductions to the service.

“Section 24 of the FIRS Act cannot be read in isolation, Section 34(1) of the FIRS Act will operate to ensure that executive tyranny does not occur where might is right and subject the 3rd defendant to recover such tax debts through the process of civil litigation. It will and should not resort to self-help. I so hold. The word ‘may’ employed by the lawmaker in Section 34(1) of the FIRS Act is mandatory and not permissive. The powers of the 3rd defendants are not at large and are limited to certain categories of taxes. I so hold.

“A for tori, pay as you earn tax is a scheme wherein personal income taxes are deducted from the salaries or wages of the employee by the employer and remitted to the relevant tax authority. The relevant tax authority is the Internal Revenue Service in the State where the taxable individual resides. See Sections 2(1)(a) and 2(2) of the Personal Income Tax Act (as amended). The Federal Inland Revenue Service is only entitled to the remittance of PAYE tax from persons employed in the Nigerian Army, the Nigerian Navy, the Nigerian Air Force, the Nigerian Police, officers of the Nigerian Foreign Service, every resident of the Federal Capital Territory, Abuja and a person resident outside Nigeria who derives income or profit from Nigeria. See Section 2(1)(b) of the Personal Income Tax Act, ( as amended).

“By the combined reading of Section 1(g) 24(1); 34(1) of the FIRS Act and Sections 2(1)(a) and 2(2) of the Personel Income Tax Act (as amended), it is clear that the defendants in this suit have no powers to deduct and retain the PAYE tax due to the Akwa Ibom State Government in satisfaction of undisputed tax liabilities that are being contested before Courts and Tribunals of competent jurisdiction and I so hold.”

Justice Inyang had also on Thursday 8th day of December 2002, in the same suit No: FHC/UY/CS/199/2022, sentenced the Accountant General of the Federation, to prison custody for an initial period of 30 days to purge himself of his contempt in facie curia.

He ordered that the prison sentence shall be renewed for a further 30 days and that till he purges himself completely of the contempt shown to this Court for tampering with the res in this suit pendent lite and disobeying the extant Orders of Court made on 28th September 2022, and 5th December 2022.

The court paper quoted inter alia:

“Order:

“Upon This motion on notice filed on 7th December 2022; brought pursuant to Order 6, Rule 1, 2 and 9 of the Court of Appeal Rules 2016 and under the inherent powers of the Honourable Court, coming up for hearing this day, praying the Honourable Court for the following order(s):

“1. An Order of this Honourable Court staying further proceedings in this suit pending the hearing and determination of the appeal lodged against the Ruling of the Federal High Court presided over by Hon. Mr. Justice J. E. Inyang in Attorney-General of Akwa Ibom State & 1 OR V. Attorney-General of the Federation & 3 ORS delivered on the 5th December 2022 as per the attached Notice of Appeal

“2. An Order of the Honourable Court staying Execution of Order/Ruling in this suit pending the hearing and determination of the appeal lodged against the Ruling of the Federal High Court presided over by Hon. Justice J. E. Inyang in Suit No: FHC/UY/CS/199?2022 – The Attorney General of Akwa Ibom State & 1 OR V. Attorney-General of the Federation & 3 ORS delivered on the 5th December 2022.

“3. And for Such further or other orders as this honourable court may deem fit to make in the circumstances.

“And after hearing K.E. Idoko ESQ, Counsel to the 3rd defendant, move his application and B.J. Ekanem, Esq, Counsel for the Plaintiffs oppose the application orally on points of law.

“And the Court having delivered its ruling:

“It is hereby ordered that: The Accountant General of the Federation, the 3rd defendant is hereby convicted summarily and sentenced to prison custody for an initial period of 30 days to purge himself of his contempt in facie curia; the prison sentence shall be renewed for a further 30 days and that till he purges himself completely of the contempt shown this Court for tampering with the res in this suit pendent lite and disobeying the extant Orders of Court made on 28th September 2022, and 5th December 2022.

“It is further ordered that: The Inspector General of Police arrest the Accountant-General of the Federation forthwith, to give full effect to the Order of this Honourable Court. The Inspector-General of Police shall be liable in contempt of this Court if he refuses to carry out this Order to the letter.

“The Inspector-General of Police shall be served forthwith, with the Enrolled Order of this Court, through the Head, Legal Unit at the Nigeria Police Force Headquarters, Asokoro, Abuja.”